How Dalfilo uses Zigpoll surveys to build confidence in new initiatives and improve attribution

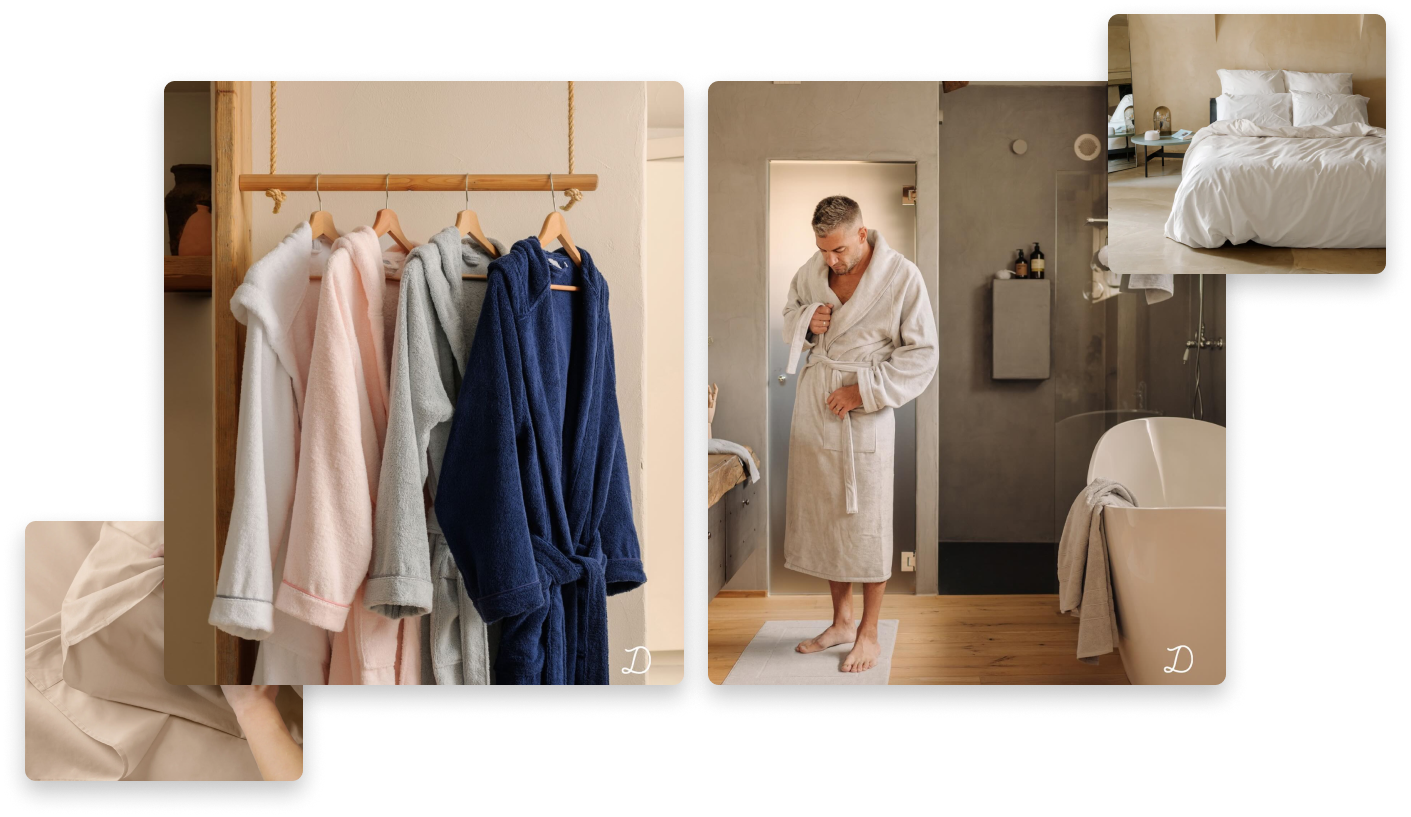

Dalfilo sells artisanal Italian household linens such as bed sheets, duvet covers, and bathrobes. They have eCommerce operations in multiple countries such as Italy, Spain, Germany, and the UK.

We had the chance to chat with Alberto Grigolo, UK Country Manager at Dalfilo, around how their organization uses Zigpoll to:

- Discover opportunities to launch new product sizes and bundles

- Triangulate which channels were driving sales so they can allocate marketing budget

- Collect customer feedback to improve the product

Dalfilo values Zigpoll's simple installation and reporting functionality

The Dalfilo team appreciated the simple installation of the Zigpoll app into their Shopify stores and the ability for non-technical team members in marketing and customer success to build surveys themselves:

"[Zigpoll] was the first app that we tried and we liked it because it was super easy to integrate. It's just one click for our developers. All the survey creation can be done by someone in marketing or someone from customer service."

They also appreciate the reporting functionality built into Zigpoll, allowing them to see reports, summaries, and insights without the need to manually build reporting:

"We also like the part where you can see the reports super easily, you can quickly gain understanding of your data just within Zigpoll."

With this reporting, their team has monthly meetings to discuss and analyze data from Zigpoll surveys:

"We have a monthly session that lasts 1 hour to discuss our post fulfillment survey since it's quite comprehensive. We analyze responses to each question, to try to see how we can improve the experience of the customer."

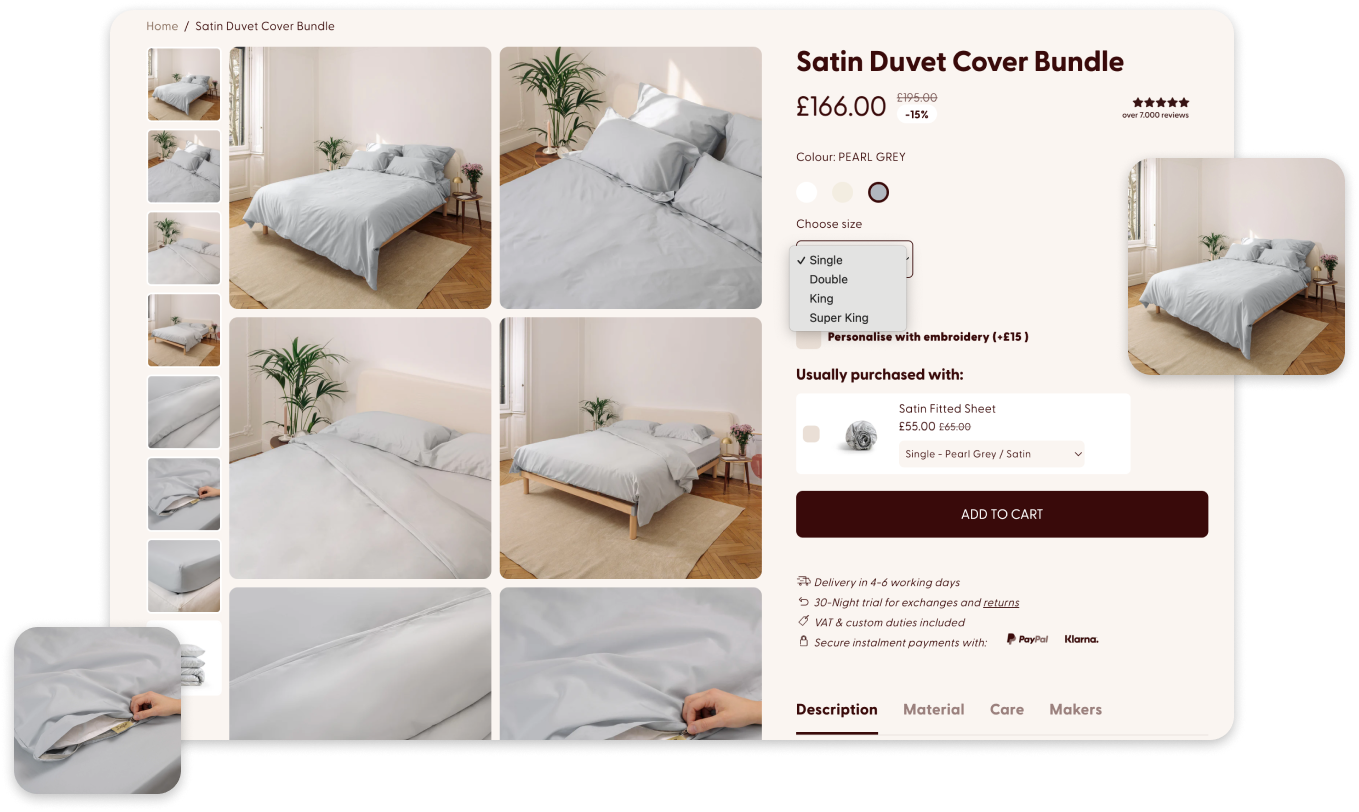

Using surveys to gather data before making decisions on new product sizes and bundles

Survey Type: "Post purchase & Post fulfillment"

Survey Question: "Would you be interested in this sizing"

When the Dalfilo team wants to test a hunch, they tweak the questions of their customer surveys to gather the data they need to make decisions.

They did this when they wanted to explore launching new sizes for their main bed sheet product:

"We were always thinking that there was a size missing. So we added a question asking whether customers would be interested in buying that specific size.

And based on that, we saw there is a lot of interest towards this product. We decided that starting in October, we will add that specific size that we saw customers interested in the post purchase."

And when they noticed competitors had gifting bundles, Dalfilo wanted to test if their customer base would be interested in a gift offering. They launched a new question on Zigpoll to see if their customers would be interested:

"There was quite some unhappiness about the fact that we were not offering gift boxes because our products can be a nice gift for friends and family.

We wanted to have a better idea of how many customers would be happy to have that kind of service. And we saw that in the survey, that many customers were.

It was a yes or no question asking whether they were interested, and the percentage of customers replying yes was super high"

Using data from surveys to gain a better picture of attribution

Survey Type: Post purchase

Survey Question: "How did you hear about us?"

Dalfilo is constantly assessing how they are allocating their marketing budget, and they use Zigpoll to support their other attribution software and get a full picture.

Their existing attribution software can only give them data on last click, but Zigpoll helps Dalfilo understand other contributing factors to purchases that may otherwise be missed by software.

They realized word of mouth was a big driver of purchases:

"Through the post purchase survey, we saw a high number of customers that were referred by friends and family. Around 9% of customers get to know us from friends and family.

We decided to try to increase that metric, so we invested in our referral program to see how it could evolve."

While also realizing that influencers were working, even though other attribution software did not make that impact clear:

"Zigpoll helps us understand how many customers got to know us from influencers, the number that we have in Zigpoll is different from the one that we have in our dashboard.

We know that we can probably invest more into influencer marketing, so we are now trying to investigate where we can cut the budget for other channels to invest in more there."

Collecting product feedback from customers instead of waiting for negative reviews

Survey Type: Post fulfillment

Survey Question: "Do you have any feedback for us?"

Dalfilo uses post fulfillment surveys to collect NPS from customers and proactively collect feedback to improve their product.

Here's one piece of feedback that their customers shared in this post fulfillment survey:

"Our product is 100% cotton. So after the first wash, it shrinks and it's written everywhere on the website, but customers were still not understanding that.

So there were many complaints in the survey saying that the products were shrinking."

Proactively asking customers for feedback with surveys prevents this negative feedback from reaching public reviews, and gives the Dalfilo team the ability to quickly improve the product packaging:

"We added some stickers inside the box to explain how to wash the products properly and emphasize the fact that being 100% cotton after the first wash, it will shrink."