How Jolly Mama uses Zigpoll's post purchase surveys to build Klaviyo segments and attribute sales

Jolly Mama is a 7 figure Shopify Plus brand creating maternity nutrition products for women before, during, and after pregnancy.

We saw in our data that Jolly Mama was collecting over 2,000 survey submissions every month, so we reached out to their founder Marie de Chaumont Quitry to learn more about how they use the first-party data they were collecting. Here what she shared:

- Building segments in Klaviyo that increase open rates and reduced spam reports

- Generating the confidence to invest in specific marketing channels such as press and healthcare partners

- Understanding how the customer base is shifting over time to launch new products and adapt their marketing assets

"I think knowing your customer is the biggest thing you could do as a brand.

We had other opportunities to put something on the confirmation page since it's such prime real estate. Loyalty, referral, Whatsapp, but I always say, it's not worth it. We're not going to change this because, as an e-commerce brand, data is what you need."

Why Jolly Mama chose Zigpoll for post purchase surveys

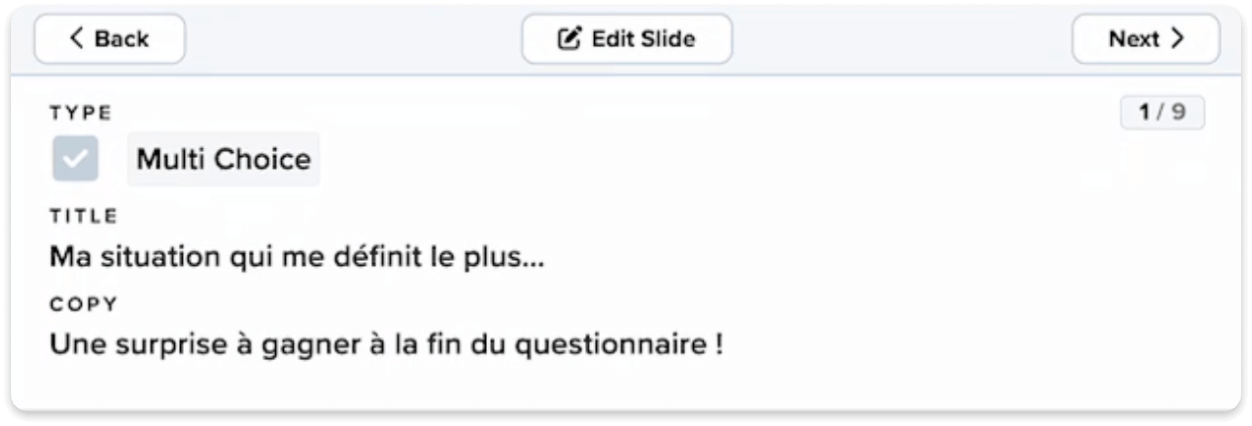

Survey Type: Post Purchase Survey

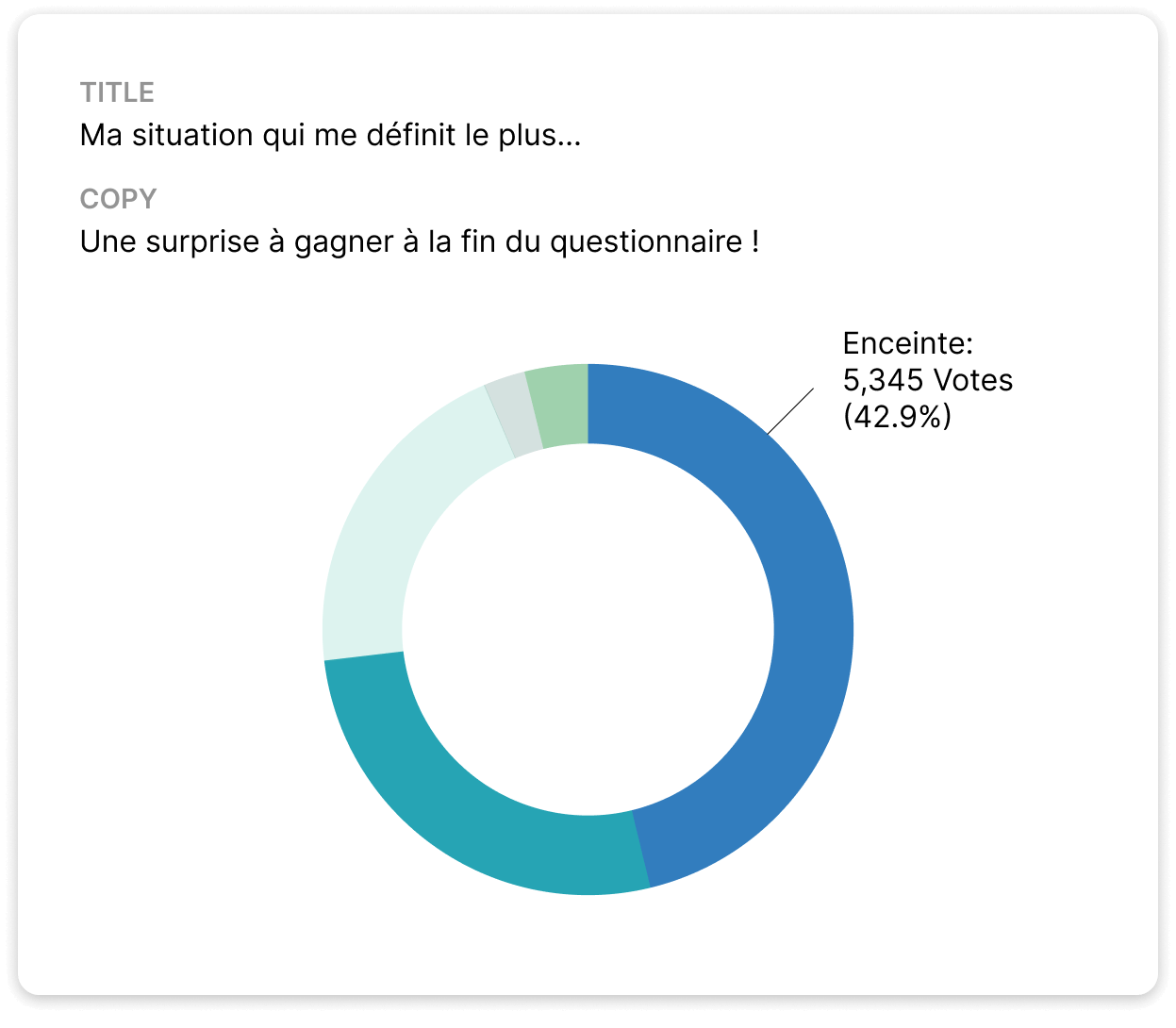

Survey Question: "What situation describes you best?" (Pregnant, Breastfeeding, Trying to conceive, Post-partum, Other?, Female problems)

Before installing Zigpoll, the Jolly Mama team realized that they needed to build a more complete understanding of their customers:

"We didn't know our customers very well and we wanted to understand them better. One of our investors mentioned that we should really know our customer personas. What are they looking for? What are their pain points? So that really was the first thing, how could we better understand our customer?"

Zigpoll surveys were easy for them to implement and also drove high response rates on the order confirmation pages:

"This is actually brilliant, a lot of people answer the Zigpoll survey. Current numbers are quite good, over 50%, helped by a ‘surprise' discount code at the end of the survey"

Something that Marie also appreciates is

"I really like the fact that you don't have to ‘grind' a lot. You already have so much displaying automatically. The regular email I get, where you use AI to summarize the key points of what happened over the last month, is really helpful."

Using post-purchase surveys to build segments in Klaviyo that increase open rates and reduce spam reports

Survey Question: "What situation defines you the most?” (Pregnant, Breastfeeding, Trying to conceive, Post-partum, Other?, Female problems)"

Jolly Mama sells nutrition supplements across a wide range of maternity stages.

Before Zigpoll, they were sending generic email campaigns promoting supplements at various stages of pregnancy, which some of their customers found emotionally sensitive.

This led to an increasing amount of emails being sent to spam, while also damaging relationships with customers.

Now with Zigpoll, their team uses survey data to build targeted segments and rules in Klaviyo that can account for these nuances, which has led to increased open rates and reduced spam reports.

"So this data point is actually very helpful because we can triangulate and say, okay, Maria, for instance, she's trying to conceive. We're not going to send Maria an email about something pregnancy-related.

We're going to send her emails about fertility, about involving her partner during the conception phase.

We send fewer emails, but they’re more targeted."

One example of segmentation that Jolly Mama can create with this data is a segment that tracks which customers are currently pregnant, valuable customer information that is impossible to gain otherwise:

"We are able to segment our customer base, we are able to send emails to all our pregnant customers. And we have rules. For example if you said you were pregnant in the customer survey over the last three months, chances are you're probably still pregnant."

Building the confidence to invest more into marketing channels

Survey Question: "How did you hear about us?” (Instagram, Word of mouth, Other, Press, Gynecologist, Podcast, Other healthcare professionals)"

Marie had to make decisions on where to allocate her marketing budget. Data from their post purchase surveys gave another data point that built confidence in decisions like investing more into a PR agency

"And the big surprise was also PR. We didn’t think a lot of people knew about us through PR, but actually it’s 5%.

It's not huge, but we thought the press was more for communication and didn't have a real impact on purchases, but it's not the case. So it encouraged us to keep investing in a PR agency we were using."

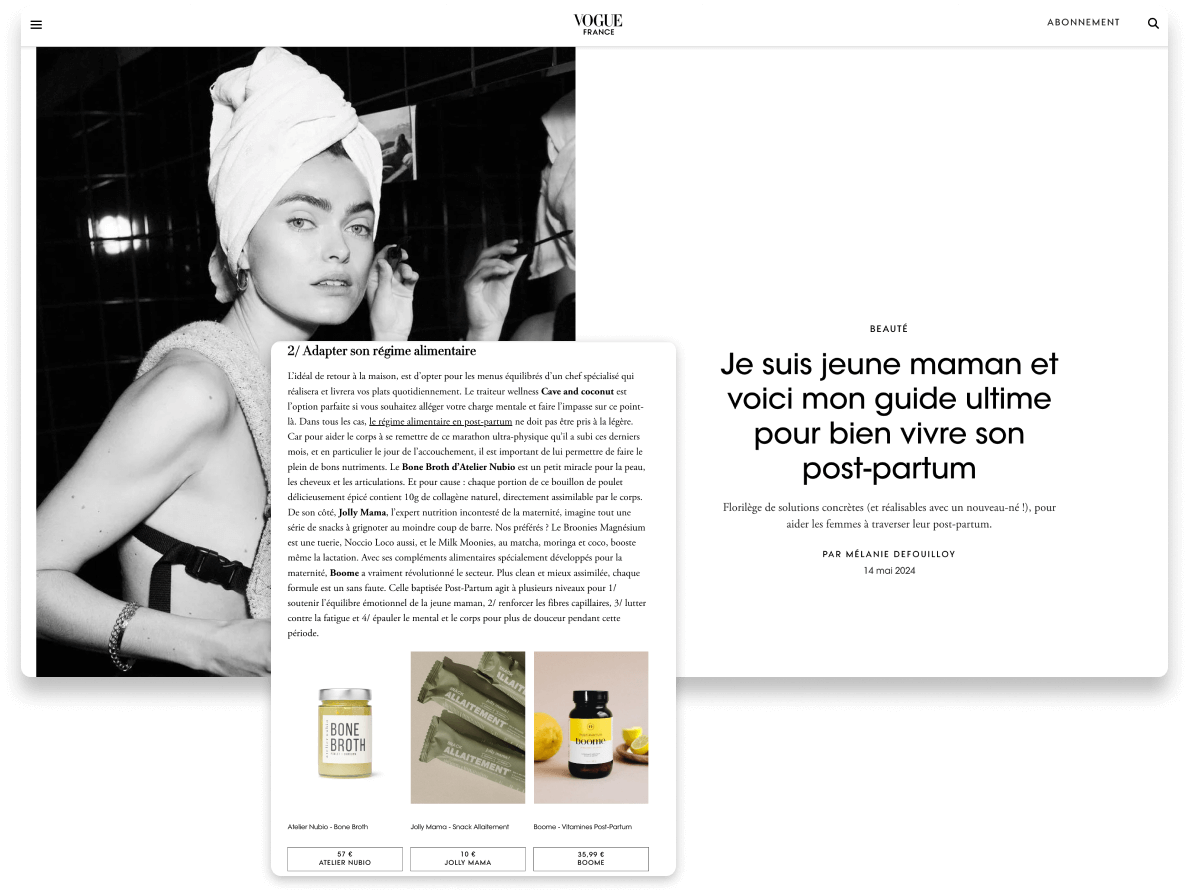

This additional data also gave them confidence in hiring a nutritionist to support building relationships with healthcare professionals, complementing other data they had from tracking affiliate codes.

“We also noticed that we had a lot of health professionals, doctors, midwives, and nurses recommending our products. And we also noticed during the survey that actually in term of numbers, they’re quite significant, at 10%.

We felt it was a good strategy to target healthcare professionals, but I would say this data point helped confirm it's actually the right approach. We hired a nutritionist to help us focus on those healthcare professionals.

At first she was only working two days for us, now it’s three days, and I think the data point helped us feel good about our choice."

Understanding how the customer base is shifting over time to launch new products and shift marketing

Survey Type: Post Purchase Survey

Survey Question: "What situation defines you the most? (Pregnant, Breastfeeding, Trying to conceive, Post-partum, Other?, Female problems)"

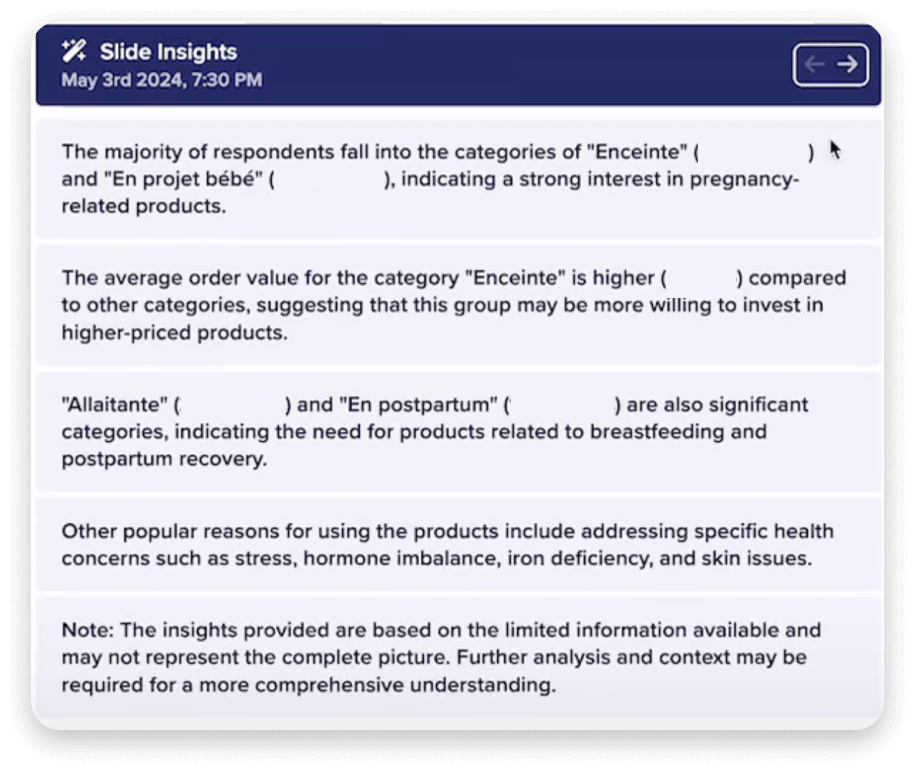

Most brands have a fixed perception of their customer base, but what Jolly Mama realized with Zigpoll was that their customer base was shifting over time.

"Yes, there are maybe two things we started to notice over the past few months, a change of mix from a lot of breastfeeding women to more pregnant women.

We originally sold breastfeeding products, but when we saw from analyzing the survey that we reached more pregnant women, we adapted our products towards those new customers."

By knowing this information on a month to month basis, the team can adapt quickly to these shifts in their customer base by promoting relevant products, launching new products, and updating their messaging across marketing assets like their Instagram or website.

"I think knowing our customers over time (not just for a couple of months or weeks) by running a small survey, is really valuable."